History, has some uncomfortable but exciting things to say about predicting market movements.

WD Gann, who was reportedly over 85% accurate in his trading during his lifetime, said something very curious towards the end of his career.

He said,

"TIME is the most important factor in determining market movements and by studying the past records of the averages or individual stocks you will be able to prove for yourself that history does repeat and that by knowing the past you can tell the future.

There is a definite relation between TIME and PRICE.

Now, by a study of the TIME PERIODS and TIME CYCLES you will learn why tops and bottoms are found at certain times and why Resistance Levels are so strong at certain times and bottoms and tops hold around them."

WD Gann also said,

"Mathematical science, which is the only real science that the entire civilized world has agreed upon, furnishes unmistakable proof of history repeating itself and shows that the cycle theory, or harmonic analysis, is the only thing that we can rely upon to ascertain the future."

...and then,

"Every movement in the market is the result of a natural law and of a Cause which exists long before the Effect takes place and can be determined years in advance. The future is but a repetition of the past."

These were pretty bold statements for WD Gann in his day and time. He had no access to computers of any kind - no calculators within reach. And yet, after years of study and hand calculations, he was able to uncover an order and rhythm of market behavior patterns - clearly enough to trade profitably nearly 9 times out of ten.

If you flash forward some 60 years, we discover Welles Wilder, the creator of the RSI indicator, the ATR indicator, among many other fundamental technical indicators that millions of traders around the world use today. A trading and technical analysis giant - like WD Gann.

When presenting his experiences with something later referred to as "the Market Delta', Wilder opens his statements this way:

"...Those who know me well know that I am not given to vain statements or careless exaggerations. What you are about to read is true ... every word of it."

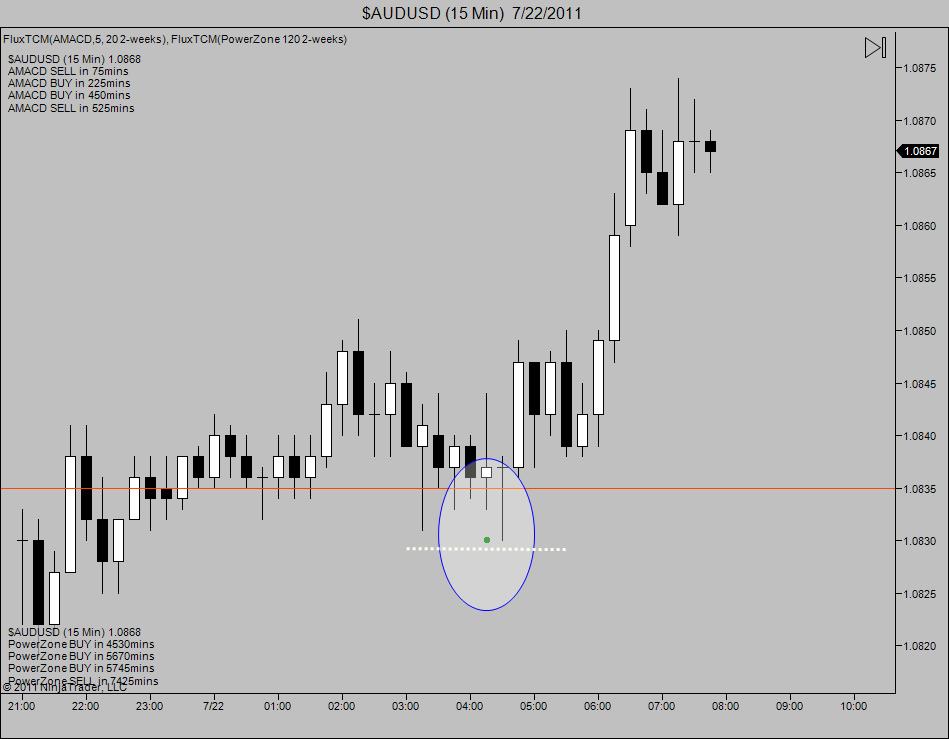

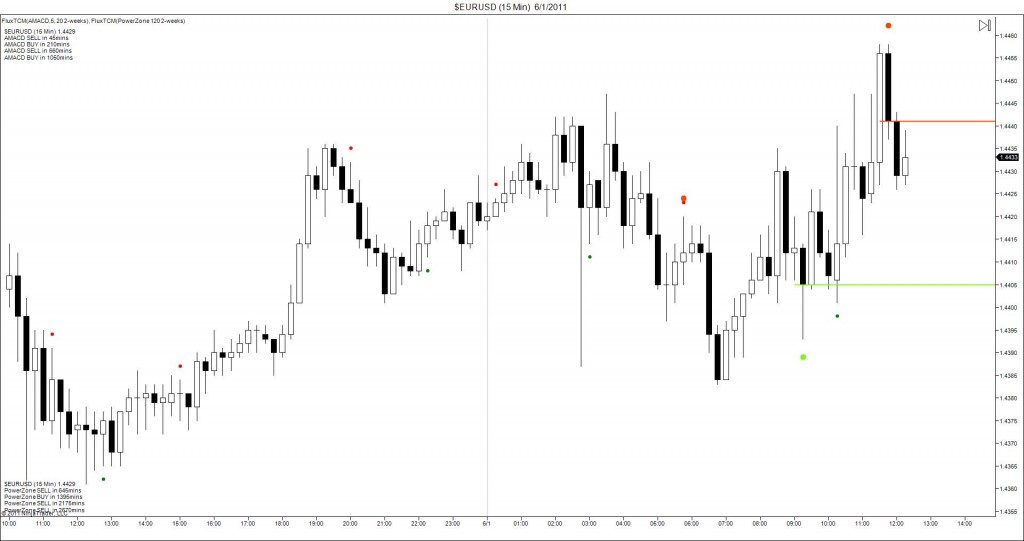

We then see market charts, like this one:

The blue boxes on the top and the bottom of the chart, are the dates and times that his system predicted the actual turn of the markets. The circles on the chart are where the markets actually stopped, and turned.

Wilder - a mathematician like WD Gann, recognized that there was more involved here - something deep and staggering in it's hidden nature.

To validate his thoughts, he hired a mathematician to calculate the odds and statistics of the probability of the times being as accurate as they were. Here's what he reported afterwards:

"I asked a mathematician to make the following calculation.

If there is not perfect order in the markets, what are the chances that One could know in advance that T- Bonds would make the highs and lows (in high/low rotation) as shown on the chart? The answer is one chance in 322 billion! To be exact, 1 in 332,687,692,541 that the turning points on the chart could have been known before they happened. "

"...For all twenty-five commodities, which include over 200 years of observing the Delta phenomenon, the average accuracy for all Intermediate-term points is as follows:

[1] 51 % of the time the projected Delta turning points will occur within two days of the projected day.

[2] 68% of the time the projected Delta turning point will occur within three days of the projected day.

[3] 81% of the time the projected Delta turning point will occur within four days of the projected day...."

I want you to keep one thing in mind - both of these men accomplished these findings without the aid of a modern day - personal trading computer.

Welles, had access to one of those computers we read about in history books - the ones that filled spaces the size of your living room. Computers with less power than the simplest of cell phones, and some watches made today.

And so three years ago, when we first turned on the Flux data mining tools and went searching for the behavioral patterns - it was an extremely exciting opportunity. Imagine if Wilder or Gann had access to a Quad Core, I5, or I7 trading computer. Imagine if we could cut their learning curve down from years to months to minutes? What if we could find the patterns in the markets - analyze thousands of historical data bars and prices in a matter of a minute - and see for ourselves if these outrageous claims were in fact valid after all this time.

And so, we turned on our tools and asked our computer a very simple question - are there any time based cycles in the market you're about to analyze for us?

We knew what a cycle looked like. We knew what noise - or junk - looked like. It was an all or nothing proposition.

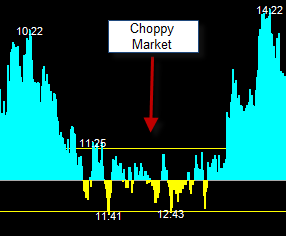

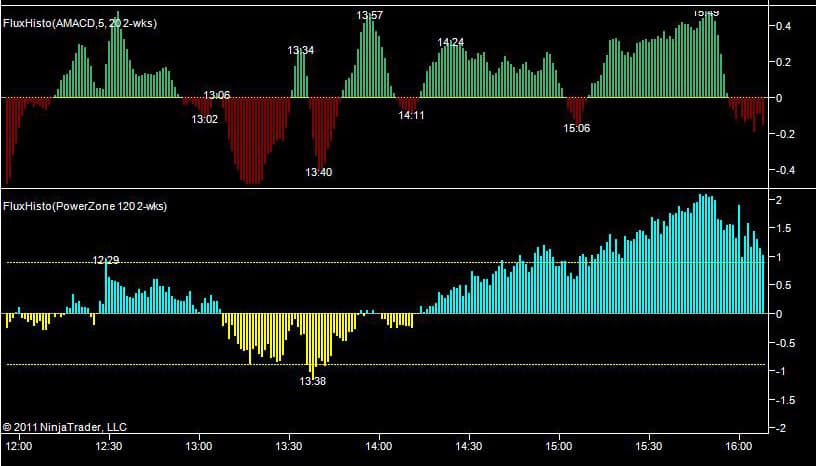

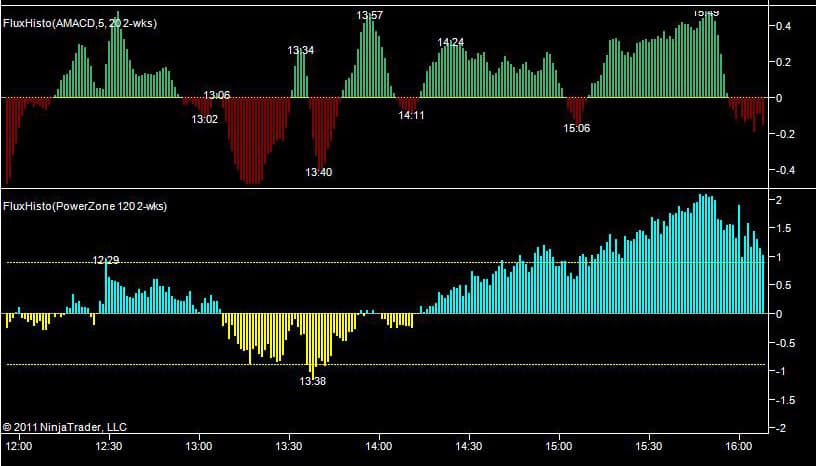

And we clicked on the mouse - and let the processor start crunching data.....here's what came back:

We practically fell out of our chairs.

There they were. Waves. Cycles. Up. Stop. Turn. Down. Stop. Turn. Up.

But were they truly predictive?

The cycles are known as far out as a week in advance. 7 days.

Wilder said he could plot a daily chart out 20, 30 years into the future. Would the same theory hold 7 days out?

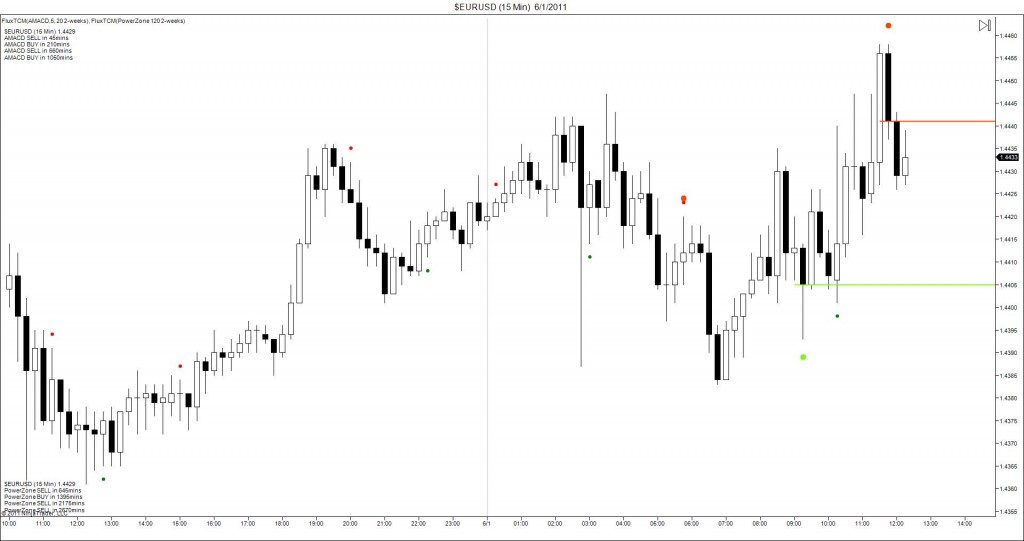

So we went back and had the computer plot a marker where the cycles had been forecast to stop, and turn. Big dots for trend reversals...small dots for momentum reversals.

And then we had our Welles Wilder moment. It's like we were watching WD Gann laughing on our screens...

Remember, the dots are what happened after the fact. Like the round circles on the Market Delta pages.

Do the majority of the markers appear at actual highs and lows of actual market price action?

Yes.

Three years later, we've studied equities, forex pairs, futures markets....commodities and bonds - you name it. 30 tick charts up to 30-60-240 minute charts. Cycles that last a few minutes out to cycles that last a few days - and the results are always the same.

500 customers and growing - trading every market and every trading methodology known to man. People are fighting back against the institutional trading computers and the big money players - harnessing the power of their trading computers to analyze the markets like we think Goldman Sachs and other financial juggernauts are doing.

I wish we could spend a few minutes with Gann, or with Welles, and show them what we've developed. I can't help but think they'd laugh and say, "Well done, boys", or "Yes sir, that's exactly what I was thinking when I was writing my thoughts down...". It's fun to speculate.

The good news, you don't have to lay out $30,000 for Welles' book. Or spend 7 years attempting to decode Gann's secret knowledge. You can load your historical data into the tool set, hit your left mouse button, and watch the results come back on your screen in less than a minute - for as many markets as you want to analyze or trade.

Take a minute to watch our free product demo. Reading about it is one thing - but seeing it for the first time - I envy you guys. I'll never forget that day, and I hope you'll have the opportunity to see it and experience it for yourself.