July 15-2021

I have been trading the Emini Dow Jones for a while and have defined a standard setup for my fast 1 minute chart as follows.

- Swing:8

- Origination Mode: Trading Days

- Source Days: 1-2-3-4

- Volatility Stop Offset ATR: 1,2

I have noticed that sometimes not always, a have too much closer dot signals, and when it happens, I just saw my 3 minute chart in another screen. Cause I like to see all my 1 minute chart in one screen, I take advantage of one utility of the Warp software called “Secondary Data Series”.

|

|

It allows me to:

For today I am using the first one. So, I used the same swing of 8, like always, and add the same instrument contract YM 09-21 but with a period value of 3. It means that in my 1 minute chart I can see the dots signals of the 3 minute chart of the YM. I want more clean signals, and as result I expect better swing trades during my Ney York session. I always used the color white and yellow, for my dot signals in 1 minute chart, but for this setup I change the colors. Red for selling pressure signals, and lime green for buying pressure signals. |

My trading plan is the same, trading the YM with 3 contracts.

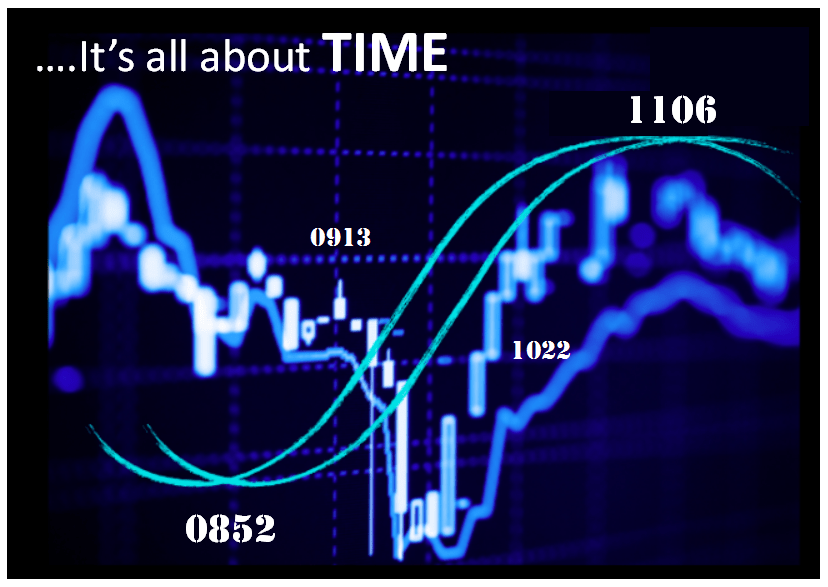

As I expected the time between predictive signals are longer (More distance). So, I decided to open my first trade at 8:21 a little bit late. The entry signal was at 8:19. Also knowing that the opening bell was at 8:30. After the price cross the last swing high, I move my stop loss at point of break even.

My daily profit goal is $500 usd, and 1 minute before the open were achieved. I think “let’s wait until 8:42” but take some profits first.

So, the momentum of the opening bell, closed the first 2 contracts.

When I have a big move like this, its ok for me to expect a least a 50% pullback or deeper, and with that in mind, I move my stop loss, a little below that point.

My last contract was covered, and I end my trading morning session.

For today with 3 contracts, @$5 per contract, I have:

60 ticks x 2 contracts x $5 = $600 usd

36 ticks x 1 contract x $5 = $180 usd

Total earned: $780 usd

Total ticks: 156

Stop loss: 16 ticks (@$5 x 3c =$240 usd)

Ratio: 0.3

It’s a good trade for me. I will continue using this configuration setup for other instruments.

Juan Fernando Vega

Mechanical Engineer

Bogota-Colombia

Spanish - Support