Predictive indicator development

Predictive indicator development traditionally hinges on the idea that a real time market analysis can be made with a real time indicator like a Shaff Trend indicator, or something from the Ehlers series of indicators that have a built in cycle component. However, the markets in the last 2-3 years had fundamentally shifted from a human centric trading model to a machine driven trading model, and predictive indicator development has done little to adapt to the "trend", no pun intended.

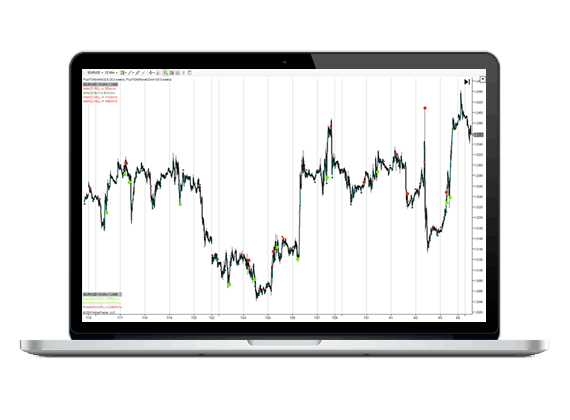

A predictive indicator that relies on historical data - however close in the past, has fundamentally missed the definition of "predictive" in the truest sense of using data that has just happened, to interpolate what may happen in the next "x" number of bars. Many of the indicators that use this technique have actually reverted to a "repainting" structure, such as this indicator below on a popular FX site:

After purchasing the indicator you see that play out in real time, and realize that it's impossible to back test any strategy. Most predictive indicator developers find that anything with a lagging component is prone to exceedingly high ratios of late signals, or false signals, in response to and by nature of the fact that they are calculating based on X bars of past in market data. However smoothed or added, predictive indicator developers need to step back and reassess in light of the massive computer trading environment that exists today.

The better solution, when considering predictive indicator development, is hinted at in this excerpt from Businessweek.com:

But as with all Wall Street feeding frenzies, there are dangers. Some critics say that when less experienced hedge- or mutual-fund traders use the software they've bought from Wall Street, they inadvertently expose their trades. How? Canny traders, mainly those who trade on behalf of big banks and brokerages with the firms' capital, may be able to identify patterns of algorithms as they get executed. "Algorithms can be very predictable," says Steve Brain, head of algorithmic trading at Instinet (INGP ), the New York City-based institutional broker.

Did you catch that? To be truly predictive, one needs study and identify patterns left behind by the algorithms of the larger institutions and brokerages. When we apply this technique to a market and study the statistically relevant patterns of the actual algorithms, look at what happens when we sit and watch the times that the algorithms are most likely to move, and judge the performance of this predictive indicator for yourself:

This predictive indicator technique yields considerably more confident results, as we are studying the market itself and watching for patterns that indicate where and when the trading computers are most likely to fire off their trades. Knowing these times, and prices, gives the smaller trader an opportunity to be in the order flow when these algorithms fire their orders off. Using a predictive indicator that measures "what just happened" with any type of a lagging component puts the user at a severe disadvantage.